Many people stumble through their financial life reacting to events and advice in an ad hoc way. As a result, few choose the most suitable financial products, some fall prey to misselling and many never realise their financial goals.

Are you one of them?

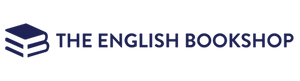

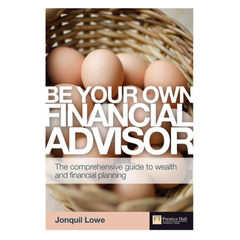

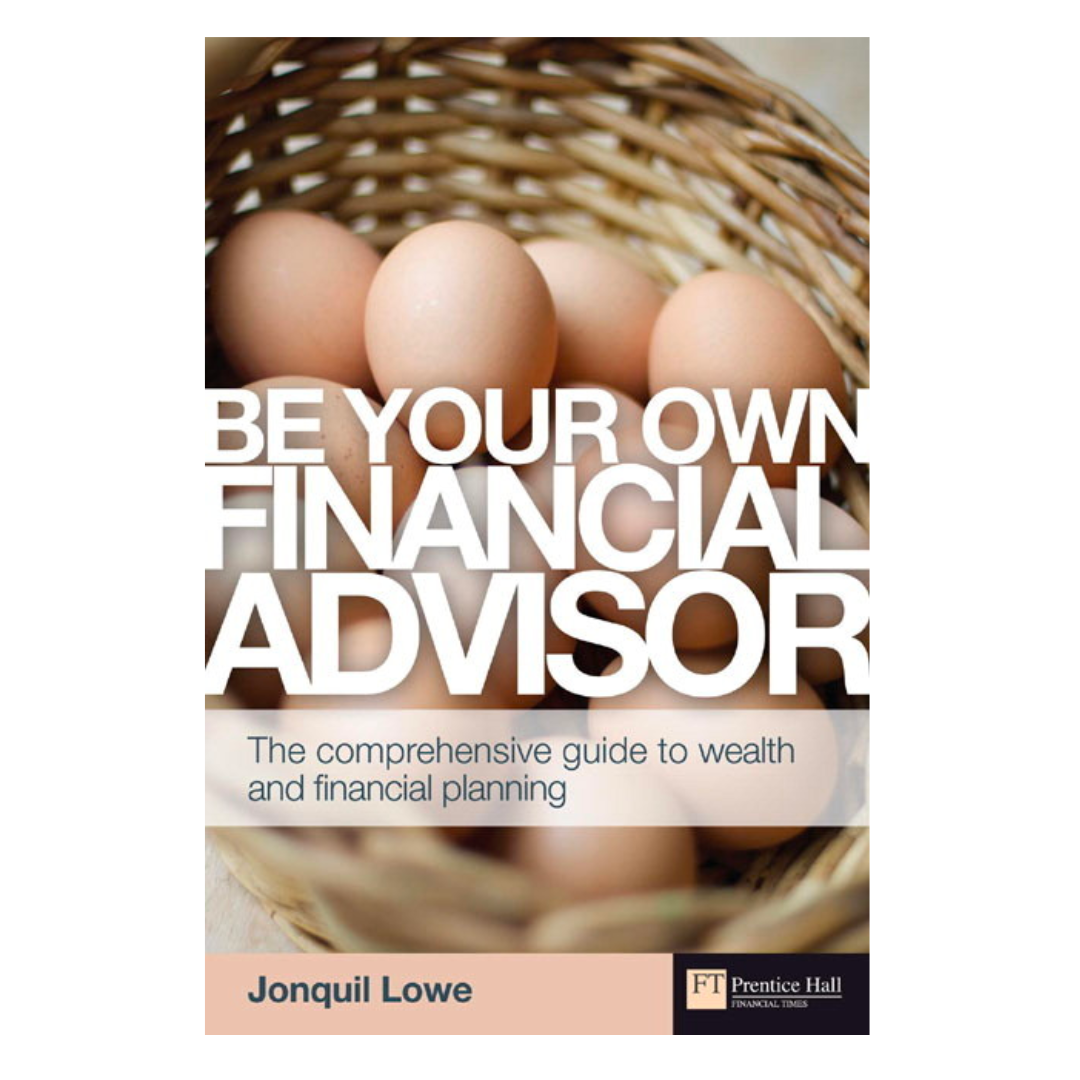

Be Your Own Financial Adviser shows you how to make sensible financial decisions without the need for expensive advice. Its accessible style, examples and case studies explain and evaluate financial products and put you firmly in control of your own financial well-being. It will advise on how to adopt the best saving, spending and investment strategies, make decisions tax-efficiently, manage risk wisely and protect and enhance your wealth. It also suggests when professional help is a good idea, and shows you how to protect yourself against misselling and get the best out of your adviser.

Be Your Own Financial Adviser will show you how to:

- Stress-test your financial decisions

- Take advantage of legal tax breaks

- Achieve your financial goals

- Manage and preserve your wealth

Accessing financial products and services is not difficult - there is no shortage of commercials, advertisements, direct mail, email and marketing calls to entice you to take out loans, buy insurance and invest your money. But choosing which products are right for you can be a hit and miss approach.

Good financial planning requires a systematic strategy. You should start by assessing your own particular circumstances, attitudes and timescales and then work out how you can implement your strategy on a long term basis.

Let Be Your Own Financial Adviser be your guide to making better financial decisions.

It includes advice on the following:

- Financial planning

- Do you need an adviser?

- Protecting your income

- Providing for your family

- Health and care

- Somewhere to live

- Building a pension

- Retirement choices

- Saving and investing

- Managing your wealth

- Passing it on